knoxville tn state sales tax

Several examples of of items that exempt from Tennessee sales tax are medical supplies certain groceries and food items and items used in packaging. Hendersonville TN Sales Tax Rate.

Tax Evasion Income Tax Tax Tax Refund

Current Sales Tax Rate.

. The Tennessee state sales tax rate is currently. This includes the. The 15 liquor-by-the-drink tax should be collected on these off premises sales.

For example if you buy a car for 20000 then youll pay 1400 in state sales tax. Ad Find Out Sales Tax Rates For Free. This amount is never to exceed 3600.

To review the rules in Tennessee visit our state-by-state guide. Fast Easy Tax Solutions. The sales tax is comprised of two parts a state portion and a local portion.

Monday August 1 Wednesday August 31 Food food ingredients and. State law requires that all businesses with exceptions for professions manufacturers and certain disabled persons inside the city of Knoxville have both city and county business licenses. 4 rows The latest sales tax rate for Knoxville TN.

When are Tennessees sales tax holidays. Liquor-by-the-drink licensees may offer drive-through pickup carryout and delivery orders of alcoholic beverages for consumption off the premises until July 1 2023. Did South Dakota v.

The tax should be collected from the consumer of the beverage. The County sales tax rate is. Thus the sale of each property is made subject to these.

5 rows The average cumulative sales tax rate in Knoxville Tennessee is 925. Tax Sale 10 Properties PDF. As reported by CarsDirect Tennessee state sales tax is 7 percent of a vehicles total purchase price.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Germantown TN Sales Tax Rate. This is the total of state county and city sales tax rates.

Integrate Vertex seamlessly to the systems you already use. The 2018 United States Supreme Court decision in South Dakota v. Ad New State Sales Tax Registration.

The general state tax rate is 7. 21556 per 100 assessed value. This bid will NOT include the 2013 2014 or the 2015 taxes due to the City of Knoxville Tennessee or Knox County Tennessee.

In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer. House located at 165 Old State Rd Knoxville TN 37914 sold for 43800 on Mar 31 2014. Local collection fee is 1 Fees.

3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. Contact the Property Tax Office at 865-215-2084 to see if you qualify for state tax relief. 3br2ba ranch built in.

This rate includes any state county city. The Tennessee sales tax rate is currently. What is the sales tax rate in Knoxville Tennessee.

We will contact businesses submitting the application by fax or email at the telephone number you list on the application and you may then provide creditdebit card information for the transaction. 3 Page 1099-K Filing Requirement 29. 2022 Tennessee state sales tax.

The Knox County sales tax rate is. 925 7 state 225 local City Property Tax Rate. State Sales Tax is 7 of purchase price less total value of trade in.

The Knoxville sales tax rate is. Friday July 29 Sunday July 31 Clothing school supplies and computers. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in.

Business LicenseTax Office 865-215-2083 This office handles business licenses permits and taxes. Has impacted many state nexus laws and sales tax collection requirements. 3 beds 2 baths 1140 sq.

Fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee. Sales Tax Tn information registration support. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in.

Wayfair Inc affect Tennessee. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. This means that an individual in the state of Tennessee who.

Local Sales Tax is 225 of the first 1600. Knoxville TN 37901-5001 or in person at the downtown Property Tax Office. Exact tax amount may vary for different items.

For purchases in excess of 1600 an additional state tax of 275 is added up to a maximum of 44. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Knoxville Tax Cpas Consultants Top Tn Based Accounting Firm

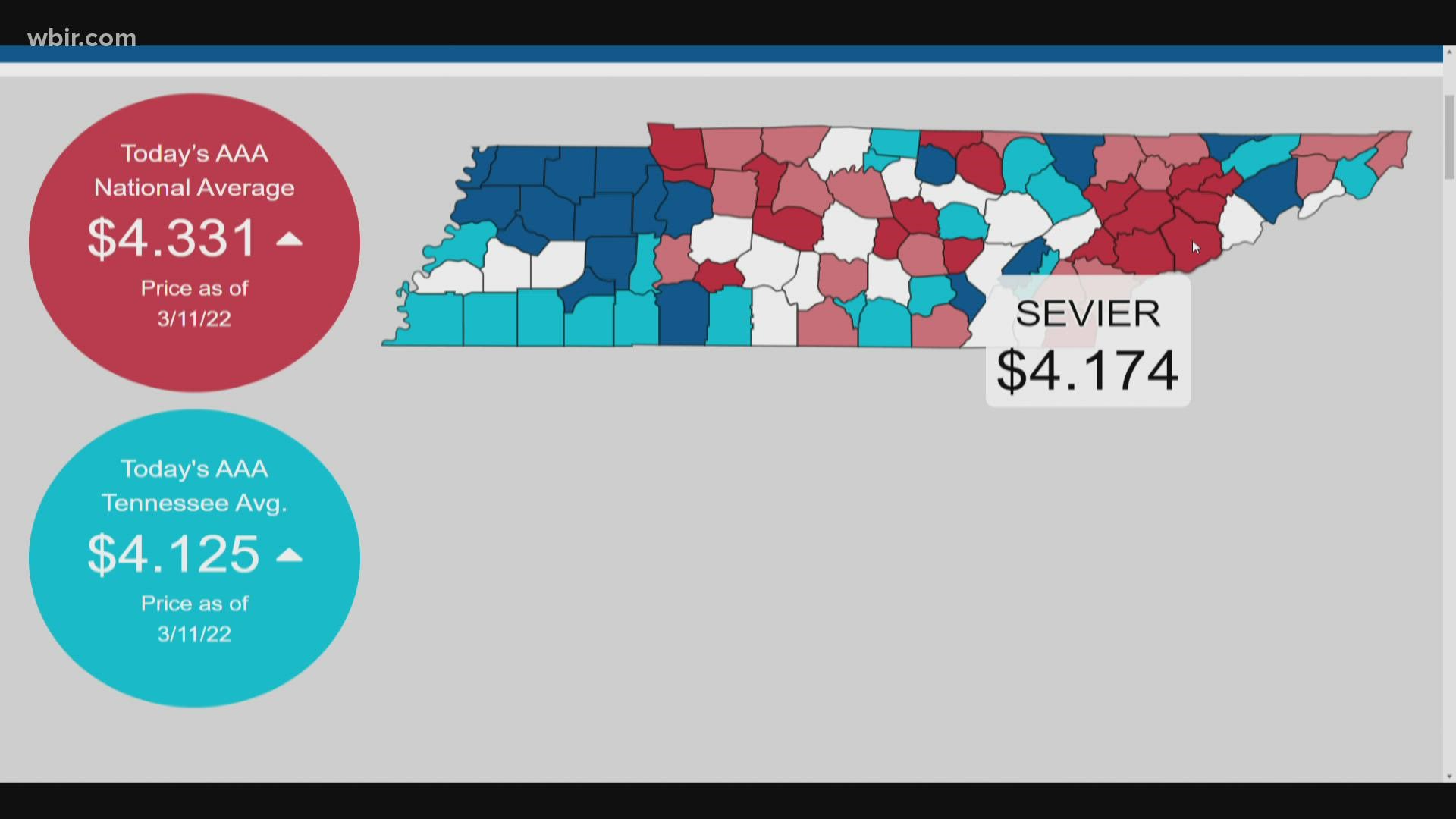

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com

Tennessee Tax Free Shopping Weekend 2022

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

How To Value A Plumbing Business In Knoxville Tn Viking Mergers

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

All You Need To Know When Moving To Knoxville Tn College Hunks Hauling Junk Moving

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Amp Pinterest In Action Business Plan Template Free Business Plan Template Business Plan Example

Airbnb Will Start Collecting Lodging Tax In Knoxville Tennessee

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue